Events

Date

July 28, 2022

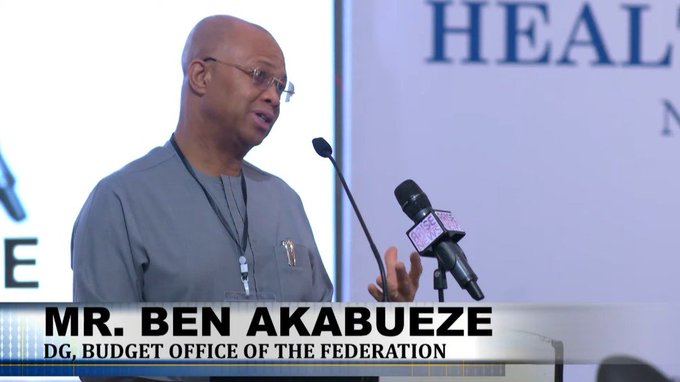

New Health Financing Approaches in Nigeria: Implementation of Sugar-Sweetened Beverage

In 2021, the Federal Government of Nigeria introduced a Sugar-Sweetened Beverage (SSB) tax as part of the Finance Act 2021, a ₦10 tax levy on each litre of non-alcoholic and sugar-sweetened carbonated drinks. This fiscal policy aimed to reduce excessive sugar consumption, similar to successful initiatives in Mexico, leading to improved population health and the prevention of non-communicable diseases (NCDs) such as diabetes and chronic kidney disease. Additionally, the tax offered the potential benefit of generating revenue for Nigeria's underfunded health sector.

In this regard, PharmAccess Foundation in collaboration with the World Bank and Nigeria Health Watch organized a policy dialogue titled 'New Health Financing Approaches in Nigeria: Implementation of Sugar-Sweetened Beverage (SSB) Tax in Nigeria'. The forum gathered stakeholders from the private, public, and non-profit sectors to assess the progress of SSB tax implementation, explore strategies for utilizing pro-health taxes for health financing, and discuss mechanisms to ensure equitable access to quality healthcare services. Through robust and engaging conversation it is acknowledged that the successful implementation of the National Health Insurance Authority (NHIA) Act, enacted in May 2022, required collaboration among all stakeholders, including the government, healthcare providers, insurance companies, and the general public. The NHIA Act aimed to address barriers to Universal Health Coverage (UHC), making health insurance mandatory for every Nigerian and legal resident while enhancing private sector participation in healthcare provision.