Editor’s Note: This week’s thought leadership piece comes from Dr Kemi of RelianceHMO, an HMO provider in Nigeria. She works to explain the different types of health insurance plans that are available for Nigerians, and highlights what everyone should take into consideration when choosing a health plan.

Despite a consensus with other heads of African Union countries at the Abuja Declaration of April 2001 to appropriate and release at least 15% of every fiscal year’s budget to healthcare, Nigeria’s health system has been historically underfunded. As a result, more than 70 percent of money spent on healthcare in Nigeria comes from individuals’ pockets, especially, at point-of-care. This increases their risk of falling into debt or poverty when they fall sick.

The government, private sector and other stakeholders have tried to make progress and improve Nigeria’s health sector. In spite of these efforts, significant funding gaps still remain and Nigeria is at risk of not attaining Sustainable Development Goal 3 (SDG 3) by 2030; ensuring equitable access to healthcare for everyone regardless of social status. This chronic under-performance of the health sector will be further exacerbated by the COVID-19 pandemic which is threatening the already fragile health sector, and jeopardizing much of the progress that has been made, improving the access and quality of health care that patients receive.

To cushion the potential negative impacts of the persistent underfunding in the health sector, efficient health financing and health insurance schemes are required to provide financial risk protection for Nigerians by ensuring that a pool of funds are available to provide for their healthcare needs. Health insurance is a type of insurance that partly or wholly covers the risk of a person incurring medical expenses when they seek healthcare. The premiums paid to cover the medical expenses incurred by the insured individual, helps cushion the cost of paying for healthcare out-of-pocket.

Health Insurance in Nigeria

No one plans to fall sick. We do not pray or wish for it, but we know that life can be unpredictable. This is the reason we need to talk more about health insurance and its significance in our lives.

The National Health Insurance Scheme (NHIS) established on 6th June 2005 is the only agency with the legal mandate of protecting Nigerians from financial distress due to healthcare expenses. The agency formulates policies guiding the operations of Health Management Organisations (HMOs), regulates their services, and designs and administers various health packages and collects premiums for various packages of healthcare.

The NHIS was also created to regulate private health insurance operated by HMOs. Therefore, it is expected that between the NHIS, its partners at the state level, the State Health Insurance Schemes (SHIS) and at the local level, Community Health Insurance Schemes (CHIS) as well as private health insurance organisations, Nigerians at large should have access to affordable care to enable them to work and contribute to the development of the nation.

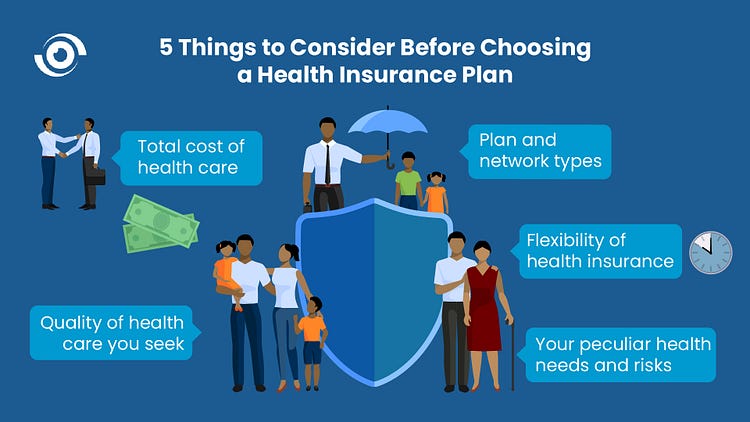

It is important to get health insurance cover that will suit your healthcare needs. With the existing number of health maintenance organisations in Nigeria, signing up with a provider might look easy, but without understanding the different types of health insurance schemes available to meet your needs, navigating the different health insurance options can be a daunting prospect.

Outlined below are 10 things you need to know when choosing health insurance plans and the available options when accessing healthcare:

1. Preferred Provider Organisation (PPO)

This is a medical health care arrangement which provides discounts to insured individuals for services that they receive from specific health care providers. This plan encourages insured individuals to use a specific network of preferred health professionals and hospitals. If you seek services out of your specific network arrangement, you are bound to incur higher costs.

PPO offers advantages such as more flexibility than some other insurance plans, substantial discounts, and a large network of professionals to choose from, which in turn offers greater value to those insured. Participants of a PPO arrangement can visit any doctor or hospital without referrals from their primary health care physicians.

2. Health Maintenance Organisation (HMO)

This health insurance plan provides medical care via a network of doctors and other health providers that are under contract with the HMOs for a monthly or annual fee.

You must have a primary health care physician in your HMO network who coordinates your care. This plan encourages policy holders to use a specific network of health care professionals and hospitals. HMO insured individuals cannot seek care outside the network of providers because the HMO won’t pay for it, except in some emergency cases or where the HMO doesn’t have an in-network provider for the health service. To see a specialist under an HMO, a referral from a primary health care doctor is required.

HMOs may be a more economical choice as HMO providers are paid on a per-member basis, regardless of the number of times they see a member. You also have the convenience of having a primary health care doctor who manages your care.

3. Point of Service (POS)

This is a managed health care insurance that provides values and gains depending on whether you use in-network or out-of-network medical services. It is a hybrid of Health Maintenance Organisations (HMOs) and Preferred Provider Organisations (PPOs).

For a POS, you are required to choose a primary health care doctor, and you still need the referral of your primary health care doctor before you can see a specialist, just like an HMO. However, POS provides coverage for out-of-network services, even though it will cost more as in the case of PPOs unless your primary health care provider made the referral to the out-of-network provider.

POS is beneficial because it combines the best features of HMOs and PPOs. The health care services of POS plans often cost lower than other policies. The coverage flexibility POS offers is another added advantage. It is an affordable plan with an out-of-network coverage.

4. Exclusive Provider Organisations (EPOs)

This is a managed health care insurance where you must get your care exclusively from health care professionals or hospitals your EPO contracts with, or else your EPO won’t pay, except in emergency cases. This healthcare network is similar to that of HMOs. However, EPO networks are generally larger than HMOs.

When using an EPO, you do not require a primary health care physician, though it is still advisable you have one. EPOs also do not require referrals before you can see a specialist.

EPO plans are usually more affordable than PPO plans. They also have lower rates than some other types of plans. The ability to see a specialist without referral is another advantage of EPOs.

5. Indemnity

This is a comprehensive form of insurance. Some have argued that it is not an insurance plan in the real sense. Indemnity plans are referred to as fee-for-service health insurance plans or traditional indemnity plans. Under this plan, the insurance company pays a predetermined percentage of charges for given health services, while the insured pays the rest of the charges.

Indemnity allows you to direct your own health care and visit any health care professional or hospital you like, with the insurance company paying a specific portion of your total charges. Under this plan, there is no provider network. You have the freedom of choice. Your insurance company will not compulsorily order you to choose a primary health care physician and you do not need referrals before you can see a specialist.

The great level of freedom offered by indemnity health insurance plan makes it advantageous as you have the option to visit any physician you choose. It also offers a greater amount of flexibility and a wide range of protective cover in a health insurance plan.

6. Health Savings Account (HSA)

The Health Savings Account is similar to the general personal savings account that most people are familiar with. However, the money in an HSA is used for health care expenses alone.

The money in an HSA is owned and controlled by the user, not an insurance company, and it is not taxed. To be eligible to open an HSA, you must have a special type of insurance called a High Deductible Health Plan (HDHP). An HDHP is a plan with a higher deductible than a traditional insurance plan. The monthly premium is usually lower, but you pay more health care costs yourself before the insurance company starts to pay its share (your deductible). A high deductible plan (HDHP) can be combined with a health savings account (HSA), allowing you to pay for certain medical expenses with money free from taxes.

Monies in HSA accounts can also earn interest. Other people can also contribute to your HAS, though limits are set. An HSA helps you save for the future.

7. Health Reimbursement Arrangement (HRA)

This is an employer fund health plan that reimburses employees for qualified medical expenses and insurance premiums. Taxes deductions for HRA reimbursement can be claimed by employers and reimbursement received by employees are tax free.

This insurance is set up by employers to cover medical expenses of their employees. It is the employer that decides the amount he can put in the plan and employees can only request for reimbursement up to the amount in the plan. Thus, subsequent bills will be covered by the employee. Employees must incur the expenses first before reimbursement is possible, after submitting proof of incurred expenses. Employees lose HRA benefits when they leave the employer’s company.

Employers tend to like this plan because they have more say and control over HRA. They decide what to put in the account. Another added benefit is it gives them tax benefits. HRA allows employees to pay for a wide range of expenses not covered by insurance. HRA is a great choice for small businesses that don’t want to deal with group insurance for employees which may be too expensive or complex.

8. State Health Insurance Schemes

The National Health Act empowers states to set up state health insurance schemes. This is a step in the right direction as a strong and functioning state health insurance system will improve access to health care for vulnerable people in communities and reduce out of pocket expenditure for healthcare.

To bridge the coverage gap, over twenty-five states have commenced the establishment of State Health Insurance Schemes and are at various stages of their implementation journey. These schemes typically involve the establishment of a governing body to direct the implementation and management of the scheme and have defined benefit packages to cater to the most common healthcare occurrences. These schemes, if successfully implemented could prove to be an important mechanism for effectively channeling government healthcare spending down to the individual with clearly measurable outcomes.

9. In December 2020, the NHIS launched the National Health Insurance Scheme Under One Roof which is an initiative for effective integration and coordination of health insurance activities in Nigeria towards the attainment of Universal Health Coverage in Nigeria.

Moving ahead towards achieving UHC, the NHIS is accelerating efforts towards the amendment of its Act to make health insurance mandatory for all Nigerians, operationalise the e-NHIS platform, secure political support for UHC at all levels of governance, focus on domestic and sustainable innovative financing, and expand its stakeholder engagement.

10. The Basic Healthcare Provision Fund (BHCPF)

In 2014, the National Health Act was signed into law and this Act established the Basic Health Care Provision Fund (BHCPF), as a vehicle for supporting the effective delivery of primary healthcare services, provision of a Basic Minimum Package of Health Services (BMPHS) and Emergency Medical Treatment for all Nigerians.

The BHCPF is designed to increase public spending in health and reduce out of pocket expenditure by consolidating funds from government sources, donors, and partners to ensure the provision of a Basic Minimum Package of Health Services (BMPHS) to all Nigerians and, strengthen the Primary Health Care (PHC) system.

A prudent and effective application of the BHCPF will improve availability of funds to address weaknesses in the health system which will in turn positively reverse our national health indices and place Nigeria firmly on the path to Universal Health Coverage.